Gold is looking bullish.

The chart above is 10yr chart with monthly candles. Note that price is sitting on strong support – an ascending trendline and a previous high. Also notice that volume has tapered off substantially in the past 1-2 years, a good sign indicating that selling pressure is waning.

The next chart, a 5yr weekly chart, shows that gold is completing wave-5 of an ending diagonal. Historically, these patterns are terminal and are followed by an explosive move in the opposite direction. Wave-3 of the ending diagonal should never be the shortest wave; thus Wave-5 should go no further than 1050, or else the pattern is invalid.

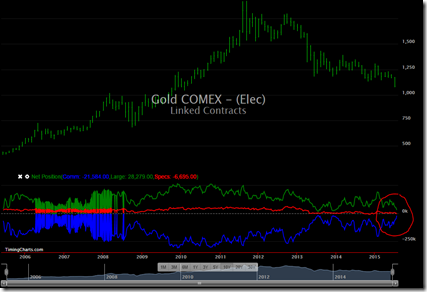

Finally, note that commercial traders are more net-long now than at any point in the past 10 years!

Finally, note that commercial traders are more net-long now than at any point in the past 10 years!

Combining all the evidence above with the bullish seasonality factor of August, I feel comfortable buying gold at these levels with a stop below 1050.